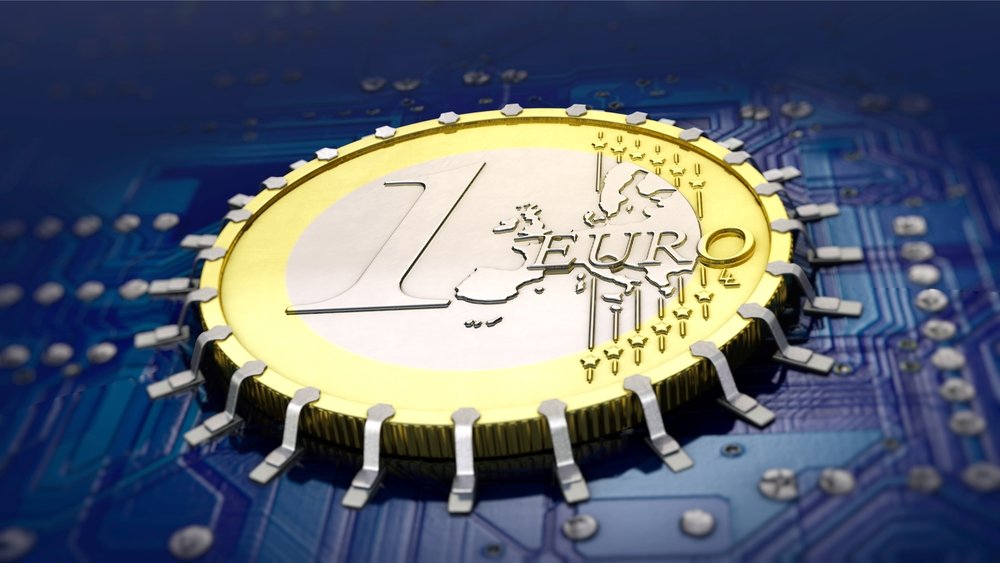

On October 26, the head of the ECB, Christine Lagarde and the board of the central bank will be in Athens for the annual meeting. Many market players estimate that the presentation of its digital plans will also take place at this meeting currency of the EU.

The goal of the European Central Bank is to create a digital currency that will meet the modern needs of electronic transactions, safely and in a protected regulated market environment. This is the response of Europe and classical capital to the growing use of cryptocurrencies.

The digital euro is supposed to make people's lives easier by providing something that does not exist today: a digital means of payment that is universally accepted throughout the euro area, for payments in stores, online or face-to-face payments. Like cash, the digital euro will be zero-risk, widely accessible, easy to use and free for basic use.

According to the ECB website it could strengthen Europe's strategic autonomy and monetary sovereignty by supporting the efficiency of the European payments ecosystem as a whole, fostering innovation and increasing its resilience to potential cyber-attacks or technical disruptions such as power outages.

Will it replace cash?

No, the digital euro will complement the function of cash and not replace it. It will be available alongside cash in response to the increasing preference of citizens to make their payments digitally, quickly and securely. Cash will continue to be available in the euro area, as will other private electronic means of payment currently in use.

Will it be an alternative currency within the Eurosystem?

No, the digital euro will be another way for theenergy payments using the euro, our single currency, in Europe. It will be convertible into banknotes on a one-to-one basis. The digital euro will respond to the growing preference of citizens and businesses to make digital payments.

How will it work?

The digital euro will enable secure direct payments in physical and online stores and between individuals, regardless of the euro area country they are in or the payment service provider they have an account with. The ECB is currently investigating how this might work in practice.

For example, the Eurosystem could develop a dedicated application for the digital euro that everyone could have equal access to. Alternatively, intermediaries, including banks, could integrate digital euro services into their existing applications, with which their customers are already familiar. In any case, those without access to a bank account or digital devices will also be able to pay with digital euro using a physical card at public intermediaries such as post offices.

The digital euro will offer both online and offline functions, preventing situations of limited connectivity. When digital euro payments are made offline, the payment details will only be known to the payer and the payee, providing the highest possible protectionof private life.

Private life the digital euro

Privacy is one of the most important design features of the digital euro. The Eurosystem has none commercial interest in the personal data of citizens concerning payments or in their disclosure to third parties. Thus, the Eurosystem does not wish to see or store users' private data.

The digital euro will enable citizens to make payments without sharing their data with third parties, beyond what is required to prevent illegal activities, according to European regulations.

In addition, the offline functionality of the digital euro will provide an even higher degree of privacy protection, since the payment details would only be known to the payer and the payee.

Yes, yes and again yes to everything.

But there is also a "backdoor" in the matter of the digitization of currencies and it is none other than the possibility of absolute control over everything.

It has not been long (i.e. a few months) since a bank in Great Britain called Nigel Farage and told him: we have closed your accounts, you can no longer make transactions (buying - selling) through us and find another one bank. As a reason for this behavior the British bank cited the role that Farage had played in BRexit.

Then, the next day, Farage made it known in his announcement that he went to 10 other banks to open accounts, to transfer his liquidity there AND ALL of them refused him.

This is how the following thought is created: if now that the classic currencies (which have the form of a banknote or a coin) there is the possibility for the bankers and the "politicians" (?) to say "I'm closing your account and ... get out of here ", BECAUSE the coins are in an intangible form, they also have the ... leeway to tell us:

look, we saw that you bought skewers (we saw through the trace, the movement of your money) while suffering from cholesterol and we judge this as suicidal ideation and in order to "protect" you we PLEDGE all of your liquidity?

In short, does the (initially) gradual and (subsequent) total transition to digital currency bring another blow to Citizen's rights?

Before I close I want to make something clear. Since 1989, in a street poll at the time (we filled in papers that were handed out), I was in favor of the abolition of physical currency (paper & metal). But I had no idea then about artificial intelligences, about supercomputers that make crossings in fractions of time and other related state (and supra-state) possibilities.

And to lighten it up a bit, listen to this here: https://www.youtube.com/watch?v=Z7tUp4xRymQ and ponder for a while.