The 3,2 billion dollars that Google made available for its takeover Nest on Monday is a reminder of the company's drive for bold decisions, but it also demonstrates a completely different policy followed by Apple, a growing company that avoids the risk.

The biggest market Apple Lossless Audio CODEC (ALAC), last year was Topsy, an analytics Twitter company that cost millions of dollars to 200. 2013's biggest acquisition of Google was Waze, a real-time data generation company from Israel, which cost 5 times more than Apple paid for Topsy. To acquire it Waze, Google had to compete with other contenders, and according to Apple as well.

Η Nest δημιουργήθηκε από δύο πρώην στελέχη της Apple και τα προϊόντα της εταιρείας παρουσιάζουν μια πολύ κομψή αισθητική design aesthetics. However, the Tony Fadell, founder and CEO of Nest , apparently doesn't have Apple's Jony Ive. Apple's attitude to acquisitions to date has been to buy small and almost inconsequential Companies. This reflects his belief Steve Jobs, who, as the story says, bought companies that was one step before the defeat and the assumption of failure.

It's hard to say that the same is true even today, for example, Google bought 1.600.000.000 for YouTube 2006. Perhaps Google admitted that at the time of the purchase it failed to predict the development of web-based video, but eight years later, and with the success of YouTube, who cares? If Google did not buy YouTube, most likely a bitter competitor such as Apple or Facebook would have done so.

Let's look at Google's markets:

- Motorola (11,5 Billion Dollars)

- DoubleClick ($3,1 billion)

- AdMob (750 Million Dollars)

- ITA Travel ($ 700>

- Postini ($ 624 million)

And here is Apple:

- Anobit (390 Million Dollars)

- AuthenTec (356 million dollars)

- PrimeSense (345 Million Dollars)

- PA Semi (278 Million Dollars)

- C3 Technologies (267 Million Dollars)

We note that Motorola and ITA Travel helped Google enter new segments (hardware and travel, respectively), while Apple's markets aimed to help the company fill the gaps in its existing products and services. Topsy is a notable exception. That said, Apple has stepped up its acquisition rate - there were 15 in its 2013 tax return. Almost the same number as Google, which bought 18 companies in 2013.

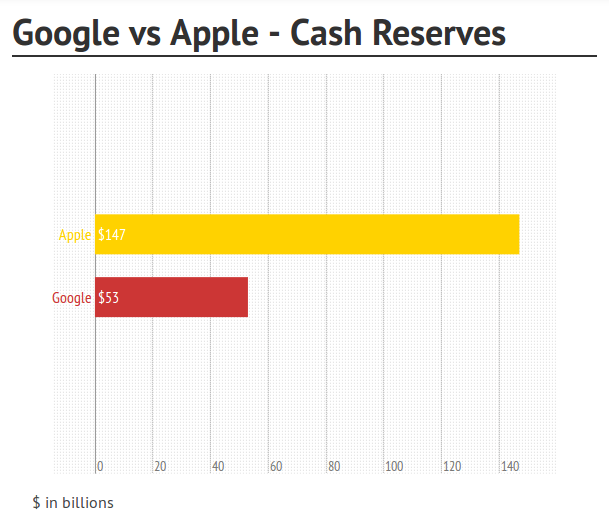

Apple's limited purchasing strategy may make sense, especially if you think the company is sitting on a mountain with billions (the company earns three times Google's earnings).

(See its diagram Mashable)

The amount so large that he has no other choice, from giving some money back to investors. This is the strategy of a mature company, but it is not what will optimize growth.