Kaspersky Lab presents it One dollar lesson, an interactive program designed to educate Internet users and teach them how to protect their money from online fraud. More specifically, the company's new training program presents users with the most common online banking threats, showing them how to protect their money in each of these cases.

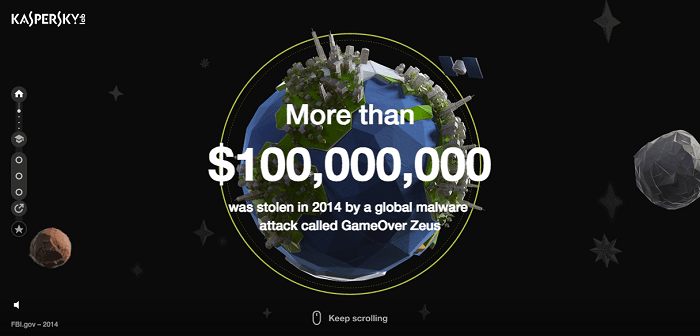

Electronic financial fraud is a particularly risky risk to Internet users. According to a survey by B2B International and Kaspersky Lab, 43% of respondents reported having experienced at least one attack on their financial information in a period of 12 months. Even more alarming is the percentage of people who lost some money due to online banking fraud and was unable to recover it fully (44% of respondents).

Users may underestimate how exposed they are during electronic financial transactions. It may be difficult to understand the details of online payment processes and the various threats that might arise along the way. Whether it's a One Dollar Lesson or thousands, the course is often the same and users should be aware of what can go wrong when they transfer money using their laptop, tablet or smartphone .

In this context, the interactive program One dollar lesson offers three training modules. Each one follows the "virtual trip" of paying a dollar in the cyberspace and towards its ultimate destination, a banking server that faces obstacles such as phishing attacks, Trojan programs, and man-in-the-middle attacks, among others. Threats are heavily depicted, as certainly the "heroes" that help the dollar reach its destination safely.

Each section of the One Dollar Lesson includes brief descriptions of the threats as well as the most recently data on trends and impacts of these online risks. This data comes from leading sources, including the research of Kaspersky Lab's own experts.

"The online banking and electronic payments are now a commonplace, with millions of people transferring money to pay their bills, donate or buy through Internet. Internet users may not be properly informed about the threats their money may face, which may make them more careless in their online transactions. That's why we created these interactive courses to help users better understand the threats and handle their money more responsibly when they are online. We believe that proper information is the best preparation for all of us, said Alexander Erofeev, Chief Marketing Officer of Kaspersky Lab.

The modules are designed with imagination, in a beautiful graphic environment and with content about the various tricks and methods scammers use to steal money and bank credentials. Each user who completes watching all three sections will be rewarded with one free three-month trial version of Kaspersky Total Security – Multi-Device, the leading solution for Kaspersky Lab for home users. The product includes the technology Safe Money, which offers additional protection for online financial transactions. For example, before approving an online payment, Safe Money checks the origin of the website and verifies its certificate through the cloud, ensuring that there is no malicious activity that could affect the transaction process on the computer.

For more information on online banking threats, and for its free trial version Kaspersky Total Security -Multi-Device, users can visit the address http://onedollarlesson.com/.

More information about the new One Dollar Lesson is available on its homepage Kaspersky Lab on Facebook.